Who Inherited Rush Limbaugh's Money: A Comprehensive Overview

The passing of Rush Limbaugh, the iconic conservative talk radio host, left many wondering about the fate of his substantial estate and who would inherit Rush Limbaugh's money. As a prominent figure in American media, Limbaugh's wealth was amassed through years of successful broadcasting, book deals, and other ventures. In this article, we will explore the complexities surrounding Limbaugh's estate, who stands to inherit his fortune, and the implications of his financial legacy.

In addition to dissecting the beneficiaries of Limbaugh's estate, we will delve into the details of his wealth accumulation, the potential tax implications, and the legal maneuvers that may arise in the inheritance process. Understanding these factors not only provides insight into Limbaugh's legacy but also emphasizes the importance of estate planning for individuals of significant wealth.

As we navigate through this topic, we will provide reliable sources and expert insights to ensure the information presented is trustworthy and authoritative. Whether you are a fan of Rush Limbaugh or simply interested in matters of inheritance and estate management, this article aims to provide a thorough understanding of who inherited Rush Limbaugh's money and what it means for the future.

Table of Contents

- Rush Limbaugh's Biography

- How Rush Limbaugh Accumulated His Wealth

- Who Inherited Rush Limbaugh's Money?

- Legal Aspects of Limbaugh's Estate

- Tax Implications of Limbaugh's Inheritance

- Public Reaction to Limbaugh's Inheritance

- Expert Opinions on Inheritance and Estate Planning

- Conclusion

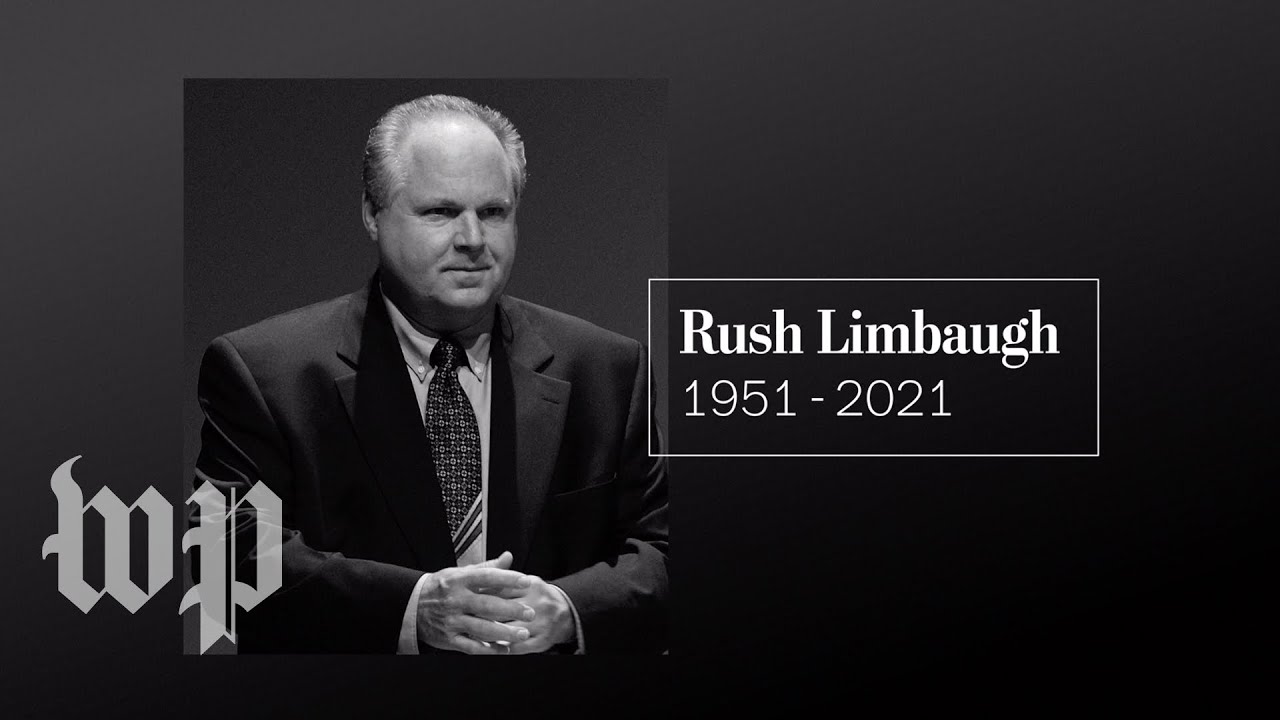

Rush Limbaugh's Biography

Rush Limbaugh was born on January 12, 1951, in Cape Girardeau, Missouri. He gained fame as a conservative political commentator and was one of the most influential radio hosts in American history. Limbaugh's career began in the 1980s, and he quickly rose to prominence with his unique style and unapologetic conservative rhetoric. Over the years, he authored several best-selling books and became a fixture in American media until his passing on February 17, 2021.

| Personal Information | Details |

|---|---|

| Full Name | Rush Hudson Limbaugh III |

| Date of Birth | January 12, 1951 |

| Date of Death | February 17, 2021 |

| Occupation | Radio Host, Author, Political Commentator |

| Net Worth at Death | Approximately $600 million |

How Rush Limbaugh Accumulated His Wealth

Rush Limbaugh's wealth was not merely a byproduct of his radio show; it stemmed from multiple revenue streams, including:

- Radio Broadcasts: Limbaugh's show, "The Rush Limbaugh Show," was syndicated across hundreds of stations nationwide, generating significant advertising revenue.

- Book Sales: Limbaugh authored several bestsellers, including "The Way Things Ought to Be" and "See, I Told You So," which contributed to his financial success.

- Merchandising: Limbaugh capitalized on his brand through various merchandise sales, including books, memorabilia, and promotional products.

- Investments: Limbaugh was also known to have made wise investments throughout his career, further adding to his wealth.

Who Inherited Rush Limbaugh's Money?

Upon Rush Limbaugh's passing, he left behind a substantial estate estimated at approximately $600 million. The primary beneficiaries of his estate are:

- Kathryn Limbaugh: Limbaugh's wife, whom he married in 2010, is expected to inherit the majority of his wealth. Reports suggest that she will receive the bulk of his assets, including cash, properties, and investments.

- Trusts and Charitable Organizations: Limbaugh was known for his charitable contributions, and it is likely that some of his wealth will be directed toward trusts and organizations he supported during his life.

- His Family: While specific details about additional heirs are not publicly available, there may be provisions for Limbaugh's other family members in his will.

Legal Aspects of Limbaugh's Estate

The transfer of Limbaugh's wealth will likely involve various legal considerations, including the execution of a will, the establishment of trusts, and adherence to state laws regarding inheritance. Key legal aspects include:

- Will Execution: Ensuring that Limbaugh's will is legally executed according to the laws of Florida, where he resided.

- Probate Process: The estate may go through probate, a legal process wherein the will is validated, and assets are distributed according to the deceased's wishes.

- Trust Management: If Limbaugh established trusts, they would need to be managed by appointed trustees, ensuring that assets are distributed as intended.

Tax Implications of Limbaugh's Inheritance

Inheriting a substantial estate like Limbaugh's comes with significant tax implications. Understanding these implications is crucial for the beneficiaries:

- Estate Taxes: Federal estate taxes may apply to Limbaugh's estate, potentially impacting how much his heirs ultimately receive.

- Income Taxes: Beneficiaries may also be subject to income taxes on any income generated from inherited assets.

- State Taxes: Depending on the state laws, additional estate or inheritance taxes may apply.

Public Reaction to Limbaugh's Inheritance

The public reaction to Rush Limbaugh's passing and the subsequent discussions about his inheritance have been mixed. Supporters admired his contributions to conservative media, while critics raised questions about the impact of wealth accumulation and the influence of wealthy media figures in politics. Social media platforms saw a flurry of activity as fans and detractors alike shared their thoughts on Limbaugh's legacy and the implications of his financial decisions.

Expert Opinions on Inheritance and Estate Planning

Experts emphasize the importance of thorough estate planning, especially for individuals with significant wealth. Key takeaways from financial advisors include:

- Establishing a Will: A clear and legally binding will can help ensure that assets are distributed according to the deceased's wishes.

- Creating Trusts: Trusts can provide tax advantages and allow for more controlled distribution of assets.

- Working with Professionals: Consulting with estate planning attorneys and financial advisors can help navigate the complexities of inheritance and tax implications.

Conclusion

In conclusion, the question of who inherited Rush Limbaugh's money brings to light various aspects of wealth, estate planning, and the legal ramifications that follow the passing of a high-profile individual. With Limbaugh's wife, Kathryn, likely to inherit the majority of his estate, it is essential to consider the broader implications of such wealth and the responsibility that comes with it. As we reflect on Limbaugh's legacy, it is crucial to understand the importance of proper estate planning and the impact of financial decisions on future generations.

We invite you to share your thoughts on this topic in the comments below, and feel free to explore other articles on our site for more insightful discussions.

Thank you for reading, and we hope to see you back here soon for more engaging content!

Is Stevie Wonder Still Alive? The Life And Legacy Of A Musical Icon

27 Year Old Actresses: Rising Stars In Hollywood

George Conway Net Worth 2023: An In-Depth Look