Understanding Leaked Credit Cards On Twitter: Risks And Precautions

In recent years, the internet has seen a surge in discussions surrounding leaked credit cards, particularly on platforms like Twitter. The topic raises significant concerns regarding cybersecurity, personal finance, and the ethical implications of sharing sensitive information online. As we delve into this issue, it is crucial to understand the mechanics behind leaked credit cards, the potential consequences, and how individuals can safeguard themselves against such threats.

With the digital landscape continually evolving, leaked credit card information can lead to severe financial repercussions for victims. Additionally, the growing prevalence of such incidents calls for heightened awareness and proactive measures to protect oneself from becoming a target. This article aims to provide an in-depth analysis of leaked credit cards on Twitter, exploring the various aspects of this critical topic.

Whether you are a casual Twitter user or someone concerned about online security, understanding the implications of leaked credit cards is essential. By grasping the risks involved and implementing protective measures, you can better navigate the complexities of online transactions and safeguard your financial future.

Table of Contents

- What is a Leaked Credit Card?

- How Do Leaks Occur?

- Consequences of Leaked Credit Cards

- How to Identify Leaked Cards on Twitter

- Protecting Yourself from Leaked Credit Cards

- Legal Implications of Leaked Credit Cards

- Frequently Asked Questions

- Conclusion

What is a Leaked Credit Card?

A leaked credit card refers to sensitive credit card information that has been exposed without authorization, typically through data breaches or malicious activities. This information can include the credit card number, expiration date, CVV, and personal identification details. When such information is publicly shared, especially on platforms like Twitter, it poses a significant threat to individuals’ financial security.

Types of Leaked Information

- Credit Card Number

- Expiration Date

- CVV Code

- Cardholder’s Name

- Billing Address

How Do Leaks Occur?

Understanding how leaked credit cards come to be is crucial for prevention. There are several methods through which these leaks can occur:

Data Breaches

One of the most common ways credit card information gets leaked is through data breaches. Cybercriminals can exploit vulnerabilities in websites and databases, gaining access to sensitive data.

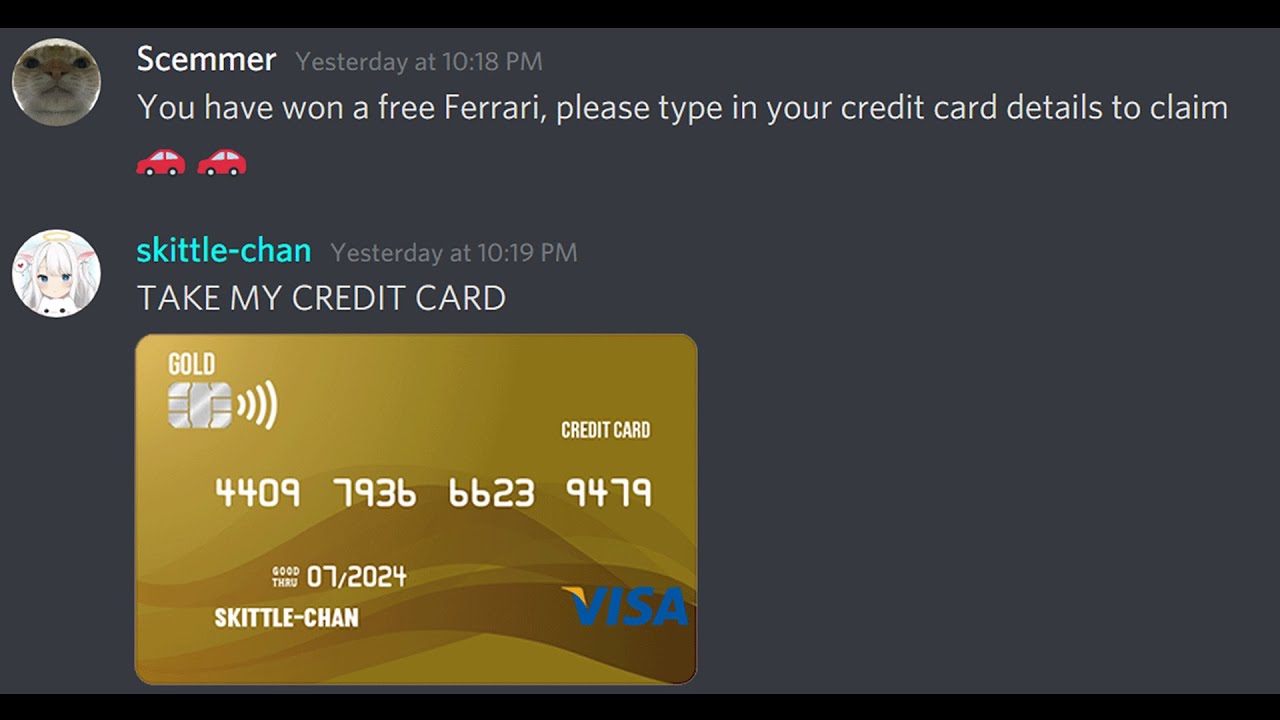

Phishing Attacks

Phishing involves tricking individuals into providing their personal information through fraudulent emails or websites. Once attackers obtain this information, they can sell it on the dark web or use it for fraudulent transactions.

Malware and Keyloggers

Malware can be installed on a user’s device without their knowledge, capturing keystrokes and transmitting sensitive information back to the attacker.

Consequences of Leaked Credit Cards

The consequences of leaked credit cards can be dire for victims. Here are some potential repercussions:

- Financial Loss: Unauthorized transactions can lead to significant financial losses for victims.

- Credit Damage: Leaked information can be used to open new accounts in the victim's name, damaging their credit score.

- Identity Theft: Criminals can use leaked information to impersonate the victim, leading to further complications.

How to Identify Leaked Cards on Twitter

Identifying leaked credit cards on Twitter may seem challenging, but there are indicators to look out for:

Monitoring Twitter Trends

Keep an eye on trending topics related to data breaches or leaked information. Often, victims or hackers will discuss leaks on social media.

Following Cybersecurity Accounts

Many cybersecurity experts and organizations regularly post updates about recent leaks. Following them can provide valuable insights.

Protecting Yourself from Leaked Credit Cards

Here are several steps you can take to protect yourself from the risks of leaked credit cards:

- Use Strong Passwords: Always create complex passwords for your online accounts.

- Enable Two-Factor Authentication: This adds an extra layer of security to your accounts.

- Monitor Bank Statements: Regularly check your financial transactions for any unauthorized activity.

- Be Cautious with Personal Information: Avoid sharing sensitive information unless absolutely necessary.

Legal Implications of Leaked Credit Cards

There are various legal ramifications surrounding the issue of leaked credit cards:

Data Protection Laws

Many countries have stringent data protection laws that require organizations to protect consumer information. Failure to do so can result in significant penalties.

Victim Remedies

Victims of credit card leaks may have legal recourse, including the ability to file complaints with consumer protection agencies.

Frequently Asked Questions

Here are some common questions regarding leaked credit cards:

Can I recover funds from a leaked credit card?

In many cases, victims can dispute unauthorized charges with their bank or credit card provider to recover lost funds.

What should I do if my credit card information is leaked?

Immediately report the incident to your bank, monitor your accounts, and consider placing a fraud alert on your credit report.

Conclusion

Leaked credit cards represent a significant threat in today’s digital world. Understanding how leaks occur and the consequences they carry is crucial for protecting your financial well-being. By implementing the protective measures outlined in this article, you can reduce your risk of falling victim to credit card fraud. Stay informed and vigilant to safeguard your financial future, and don’t hesitate to share your thoughts or experiences in the comments below.

We encourage you to share this article with others and explore more resources on cybersecurity and financial safety on our website.

Glorilla Leaked: The Untold Story Behind The Controversy

Discovering Hd Hub 4u.com: Your Ultimate Destination For Entertainment

Justin Bieber Car Wreck: A Deep Dive Into The Incident And Its Aftermath