Leaked Credit Cards 2024: Understanding The Risks And Prevention Strategies

In 2024, the issue of leaked credit cards has become a significant concern for consumers and financial institutions alike. As cybercriminals continue to develop more sophisticated methods for stealing sensitive information, it is essential for individuals to be aware of these threats and take proactive measures to protect their financial data. This article delves into the intricacies of leaked credit card information, the impact it has on consumers, and effective strategies to prevent such breaches.

Credit card leaks not only affect the victims financially but can also lead to identity theft and long-term credit issues. Various factors contribute to these leaks, including inadequate security measures by businesses, phishing scams, and even data breaches from reputable companies. Understanding how these leaks occur and what steps can be taken to mitigate the risks is crucial for anyone who uses credit cards in their daily transactions.

In this comprehensive guide, we will explore the various aspects of leaked credit cards, including the causes, consequences, and preventive measures. By equipping yourself with this knowledge, you can better safeguard your personal and financial information against the ever-evolving landscape of cybercrime.

Table of Contents

- What Are Leaked Credit Cards?

- Causes of Credit Card Leaks

- Consequences of Leaked Credit Cards

- Preventive Measures Against Credit Card Leaks

- How to Monitor Your Credit Card

- What to Do If Your Credit Card Is Leaked

- The Role of Financial Institutions

- Future Trends in Credit Card Security

What Are Leaked Credit Cards?

Leaked credit cards refer to instances where sensitive credit card information, such as card numbers, expiration dates, and CVV codes, are exposed to unauthorized parties. This exposure can occur through various means, including data breaches, phishing scams, and insecure online transactions.

Types of Leaked Information

- Card Number

- Expiration Date

- CVV Code

- Cardholder Name

When these details are leaked, they can be used to make fraudulent purchases or even sell the information on the dark web, leading to significant financial losses for both individuals and businesses.

Causes of Credit Card Leaks

Understanding the root causes of credit card leaks is essential for developing effective strategies to combat them. Here are some of the most common causes:

Data Breaches

Data breaches occur when cybercriminals gain unauthorized access to a company's database, resulting in the exposure of sensitive customer information. High-profile breaches in recent years have affected millions of consumers.

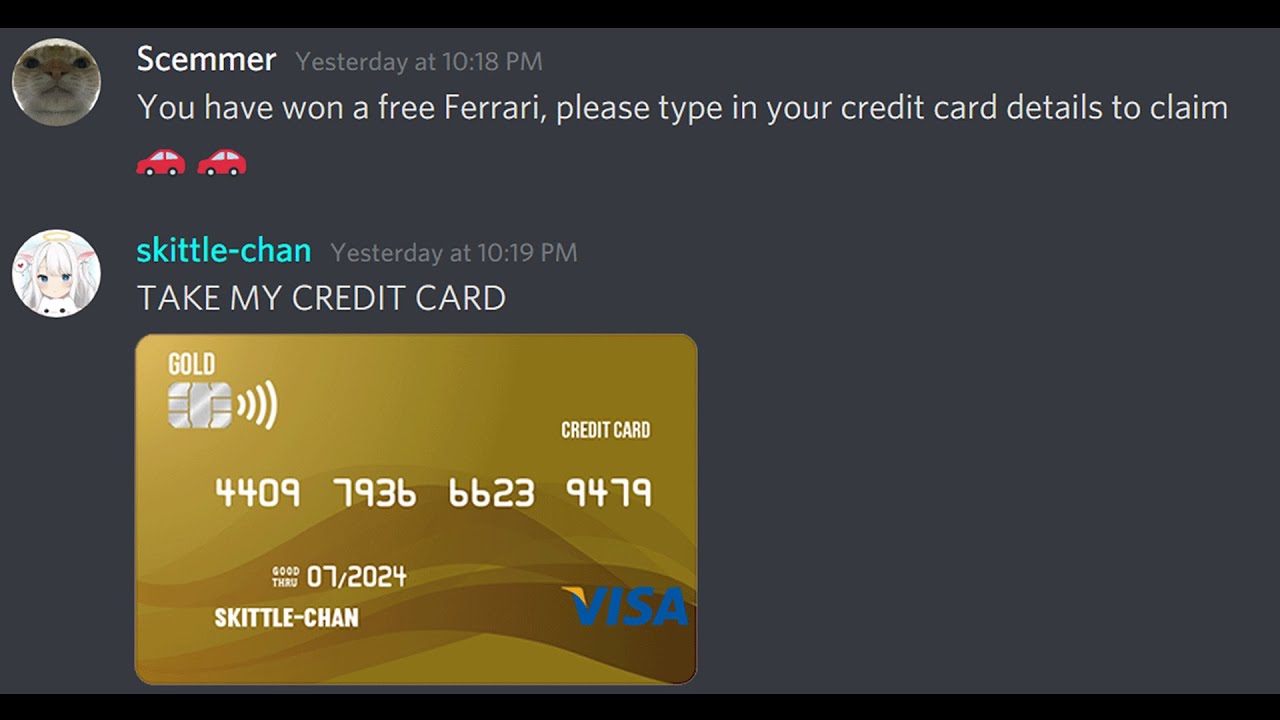

Phishing Scams

Phishing scams often involve tricking individuals into providing their credit card information through fake emails or websites that appear legitimate. These scams can be highly sophisticated and difficult to detect.

Insecure Online Transactions

Many consumers still engage in online transactions without ensuring that the website is secure. Transacting on unsecured websites increases the risk of credit card information being intercepted by cybercriminals.

Consequences of Leaked Credit Cards

The ramifications of leaked credit card information can be severe and far-reaching. Some of the most significant consequences include:

Financial Loss

Victims of credit card fraud often face significant financial losses, with unauthorized transactions draining their accounts. In some cases, individuals may also incur fees from their banks or credit card companies.

Identity Theft

Leaked credit card information can lead to identity theft, where criminals use the victim's personal information to open new accounts or make purchases in their name, further complicating the recovery process.

Long-Term Credit Damage

Even after resolving fraudulent charges, victims may experience long-term damage to their credit scores, making it difficult to secure loans or credit in the future.

Preventive Measures Against Credit Card Leaks

Taking proactive measures is essential for safeguarding your credit card information. Here are some effective strategies:

Use Strong Passwords

Ensure that your online accounts have strong, unique passwords that are difficult to guess. Consider using a password manager to keep track of your passwords securely.

Enable Two-Factor Authentication

Whenever possible, enable two-factor authentication on your accounts. This adds an extra layer of security by requiring a second form of verification, such as a text message or authentication app.

Monitor Your Accounts Regularly

Keep a close eye on your bank and credit card statements for any unauthorized transactions. Report suspicious activity immediately to your financial institution.

How to Monitor Your Credit Card

Monitoring your credit card is crucial for early detection of potential fraud. Here are some methods to stay vigilant:

Set Up Alerts

Many banks and credit card companies offer alert systems that notify you of any transactions over a specified amount or any unusual activity on your account.

Use Credit Monitoring Services

Consider utilizing credit monitoring services that keep track of your credit report and notify you of any changes or suspicious activities.

What to Do If Your Credit Card Is Leaked

If you suspect that your credit card information has been leaked, take immediate action:

Contact Your Bank

Notify your bank or credit card company as soon as possible. They can freeze your account and investigate any unauthorized transactions.

Change Your Passwords

Change the passwords for your online accounts, especially those linked to your financial information.

The Role of Financial Institutions

Financial institutions play a crucial role in preventing credit card leaks. They must implement robust security measures, including:

Encryption Technologies

Utilizing encryption technologies helps protect sensitive information during transactions, making it more difficult for cybercriminals to access data.

Fraud Detection Systems

Implementing advanced fraud detection systems can help identify suspicious activities and prevent unauthorized transactions before they occur.

Future Trends in Credit Card Security

As technology continues to evolve, so too will the methods of securing credit card information. Some future trends include:

Biometric Authentication

Biometric authentication methods, such as fingerprint or facial recognition, are likely to become more widespread, providing a higher level of security for transactions.

Blockchain Technology

Blockchain technology has the potential to revolutionize transaction security by creating a decentralized ledger that is incredibly difficult to tamper with.

Conclusion

Leaked credit cards pose a significant threat to consumers in 2024, but by understanding the causes, consequences, and preventive measures, individuals can protect themselves against fraud. It is crucial to remain vigilant and take proactive steps to safeguard your financial information.

We encourage you to share your thoughts in the comments below, spread the word about the importance of credit card security, and check out our other articles for more insights on protecting your personal information.

Penutup

Thank you for reading our comprehensive guide on leaked credit cards in 2024. We hope you found the information valuable and empowering. Stay safe, and we look forward to seeing you back on our site for more informative articles in the future!

Everything You Need To Know About HD Hub4U: The Ultimate Streaming Platform

Downloadhub4u Movie: The Ultimate Guide To Your Favorite Films

Noemy Twitter: The Rising Star Of Social Media